The Working Time Regulations 1998 and The Working Time Regulations (Northern Ireland) 2016 entitle all staff members to a minimum of 28 days (5.6 weeks) of annual leave.

This can include the public/bank holidays in the UK country in which the staff member works.

There is a minimum allowance of 20 days that must be taken in the year. This is pro-rated for part-time staff.

Staff members employed since 15 April 2015 have a leave year starting on 1 January and this should not be changed.

The leave entitlement is detailed in the employment contract (for contracts created before July 2024) or in the Key Terms document, which forms part of the contract or agreement with the MP.

Annual leave entitlement may rise with the length of service within the first three years.

Staff members are encouraged to take their full annual leave entitlement within the leave year to ensure a healthy work-life balance.

Managing annual leave

It is the responsibility of staff and their managers to maintain a record of all annual leave within the office.

This will make it easier to know who has taken leave out of their entitlement and enable the MP to monitor that staff are at least taking their statutory requirement.

Calculating annual leave for casual workers

Casual workers accrue annual leave pay based on their hours worked.

Their annual leave entitlement (the rate at which they accrue annual leave) is 28 days (inclusive of bank holidays).

Instead of requesting their holiday pay, or being paid the entire amount when they leave, each month their holiday pay will be included in their monthly pay. It will appear as a separate line on their payslip.

This will reduce errors and ensure the MP has up-to-date spending figures in their budget rather than having an unexpectedly large claim at the end of the casual workers’ contract.

If you have any questions, please contact a member of the IPSA Payroll team who can assist you.

Calculating annual leave for term-time staff

Term-time staff work only when the house is in session or the staff member’s children are at school.

They accrue annual leave based on the number of weeks worked across the year. This is done by multiplying the annual leave entitlement and the bank holiday entitlement by the number of weeks worked and dividing by 52 (the number of weeks in the year). For example:

25 + 8 bank holidays annual leave for someone working 39 weeks across the year would be 33/52 × 39 = 24.75 days

This should then be multiplied by the full-time daily hours to give the calculation in hours. Therefore for someone who works 37.5 hours per week, the annual leave should be multiplied by 7.5 (hours worked each day).

This is 24.75 × 7.5 = 185.62 or 186.0 when rounded to the nearest half-hour.

If the staff member works part-time, the above calculation needs to be pro-rated in accordance with the number of hours worked across the week.

As a term-time only worker, your holiday entitlement will be based on the number of weeks you work across the year, and you are restricted to taking your leave during the weeks that you are not contracted to work. This means that instead of requesting their holiday pay, or being paid the entire amount when they leave, each month their holiday pay will be included in their monthly pay. It will appear as a separate line on their payslip.

Compressed hours

It is important to inform IPSA if a member of staff is working compressed hours. IPSA can produce a contract to reflect this agreement.

Payment or recovery of annual leave

Upon leaving, the calculation for the payment/recovery of annual leave to MPs’ staff is:

Days: annual basic salary / 260 = daily annual leave rate × numbers of days due or overtaken

Hours: annual basic salary / 52 / weekly working hours = hourly rate × number of hours due or overtaken

If there is anything not covered in this guidance, please call Members' HR at 020 7219 2080 or email membershr@parliament.uk.

MPs' staff can also speak to HR practitioners directly by calling 0207 219 2617.

Holiday entitlement

IPSA Online uses hours and not days.

This approach ensures consistency with part-time and other staff on flexible arrangements who need their holiday to be stated in hours.

IPSA Online must be programmed to know the staff member’s working pattern. If this is incorrect, the holiday entitlement is likely to be wrong.

To convert holiday days into hours, use these calculations:

Full-time

Annual holiday entitlement x hours per day = hours per year

25 days x 7.5 = 187.5 hours per year

Part-time

Full-time holiday hours / FTE hours per week x contracted PT hours per week = part time hours per year

187.5 (25 days) / 37.5 x 20 = 100 hours

If the part-time staff member works fewer than five days per week, please continue to the next step to calculate any bank holiday entitlement.

Bank holidays

If a staff member works fewer than five days per week (usually because they work part-time or compressed full-time hours), IPSA Online calculates the bank holiday entitlement automatically.

The relevant bank holidays will vary according to the UK country the staff member lives in.

An example part-time calculation is below:

Step 1

A staff member works 20 hours per week over four days. Those days are Monday, Tuesday, Wednesday and Friday. They work five hours per day. They live in Scotland.

9 bank holidays x 7.5 / 37.5 hours x weekly hours (20 in this example) = 36 hours

IPSA Online uses the staff member’s personal working pattern to determine how many hours to book for bank holidays on the days that fall within their work pattern.

This is processed automatically as long as the work pattern is correct in IPSA Online.

Step 2

In 2025, there are nine Scottish bank holidays, seven of which fall on either a Monday, Tuesday, Wednesday or Friday.

7 x 5 hours per day = 35 hours

Going back to step 1, the bank holiday entitlement was calculated as 36 hours, but based on the personal working pattern those seven bank holidays equate to 35 hours. So, the normal holiday entitlement for the year will be increased by the difference, which is one hour.

Please note that if the difference between steps 1 and 2 gives a negative figure, the normal holiday entitlement for the year will be reduced by the difference, as they will not be working those hours because of their work pattern.

Carrying over leave

Staff members cannot carry forward more than five days' holiday (pro rata if part time) in any leave year, unless they have been prevented from doing so because of sickness absence or maternity, paternity or adoption leave. (Please refer to Carry over of annual leave if absent).

MPs are encouraged to ensure staff use their holiday at appropriate times and in line with the statutory guidance.

The IPSA Online system will automatically roll over any unused holiday up to five days for a full-time member of staff.

Holiday pay cannot be paid to an individual unless they leave their employment.

Holiday leave year

The holiday leave year stated in the MPs’ staff employment contract is January-December and this should not be changed.

There are some exceptions to this for staff members who were employed before 2015.

IPSA Online is built to accommodate the leave year as per the individual’s contract.

Upon staff leaving, IPSA will check the holiday being requested for payment. If the accrued amount is not in line with the calendar leave in the contract, IPSA may refuse payment for the whole amount.

Joining mid year

If a staff member joins during the year and you want to calculate their holiday entitlement, this is the calculation to use.

The holiday calendar leave year runs from 1 January to 31 December.

Example:

They joined on 6 May with 25 days' holiday entitlement.

First, count the number of calendar days from 6 May to 31 December = 240 days.

25 days x 7.5 = 187.5 hours for the whole year

187.5 / 365 x 240 = 123.28, round up to 123.5 (always round up to the nearest half hour)

Any bank holidays due would be in addition.

Leaving mid year

If a staff member is leaving during the year, this calculation can be used to determine if they have any holiday left to take, or if they have taken too much.

Example:

They are leaving on 27 August with 28 days' holiday entitlement.

First, count the number of calendar days from 1 January to 27 August = 239 days.

28 days x 7.5 = 210 hours for the whole year

210 / 365 x 239 = 137.50 hours

This can be compared to the leave they have taken.

Staff members should speak to their line manager to agree whether they can take any remaining holiday before they leave or can be paid for anything outstanding.

Upon staff leaving, IPSA will check the holiday accrued during the calendar year against what they have taken and determine the amount to be paid or recovered from their final pay.

Increases during years 2 and 3

The IPSA contract tool allows for increases to be awarded during years 2 and 3, ranging from 25-30 days (FTE).

If this has been included in the original contract, IPSA Online will automatically increase entitlements from 1 January (at the relevant year), not from the anniversary start date.

Booking holidays using IPSA Online

Staff can use IPSA Online to book their holiday. Sufficient notice should be provided.

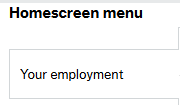

Open IPSA Online.

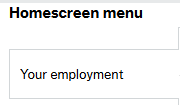

Select Your employment.

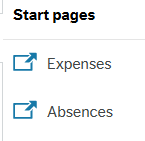

Select Absences.

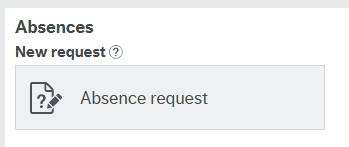

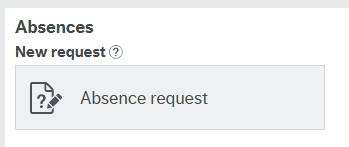

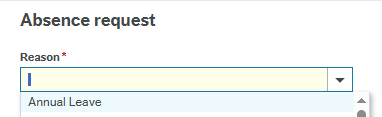

Select Absence request.

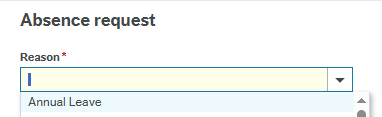

Select Annual leave from the drop-down Reason field.

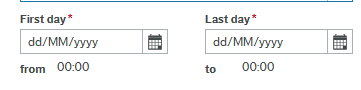

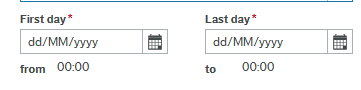

Insert the first and last day.

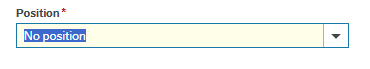

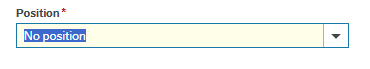

A Position box will appear after the period is selected. If the job title does not appear automatically, please select it from the drop-down box of the Position field.

If only a half day is needed, keep both the first and last day as the same date and amend the next field to No.

Click Submit at the bottom of the page.

10. All work patterns and relevant bank holidays, depending on where the staff member lives, have been programmed into IPSA Online. This means when they book time off, they are only using annual leave for time you would actually be working.

11. This request will be sent automatically to the payroll proxy or MP to approve or reject. An email alert will be sent confirming whether it has been approved or not.

Deleting/amending holidays using IPSA Online

If a staff member wishes to delete a period of holiday, please use these steps.

Please note that if only some of the original period booked is no longer needed, the whole period will need to be deleted. After this is approved, the staff member can submit a new period.

Open IPSA Online.

Select Your employment.

Select Absences.

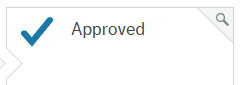

Select Approved.

A list of dates booked will be shown. Select the period you want to delete.

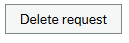

Select the Delete request button at the bottom of the screen.

You will then see a pop-up box that asks you to check whether you want to complete the action. Select Delete request to complete.

This request will be sent automatically to the payroll proxy or MP to approve or reject. An email alert will be sent confirming whether it has been approved or not.

Running the MP Office Annual Leave & Sick Details report

The MP Office Annual Leave & Sick Details report is only available to full payroll proxies in IPSA Online.

It will display any annual leave (including relevant bank holidays for staff who work fewer than five days) and sick absence we have on record.

The report can be run at any time.

If there is any missing sick absence from the report, please email payroll@theipsa.org.uk with these details and we will update our records.

If there is any annual leave missing, please ask the staff member to add these to IPSA Online. This can be done retrospectively.

If there is any annual leave that is incorrect, please email payroll@theipsa.org.uk so we can update our records.

If a bank holiday or the hours per day appear incorrect, this may be because we have the wrong working pattern for the individual. A contractual changes form will need to be submitted to update this.

Open IPSA Online.

From the main menu, select Reports, then MP reports and then MP Office Annual Leave & Sick Details.

Press the Search button in the middle of the screen.

You can change the year at the top of the screen. It will default to the current calendar year.

The data will appear on screen. The report can be exported and downloaded, selecting "Default Excel" if needed.

Useful videos

IPSA Online holiday key facts

Holiday proration for joiners and leavers

Converting holiday days into hours

Casual holiday accrual

Holiday carry forward

Holiday increases years 2 and 3

Part-time and bank holiday entitlements

Read our five top tips for staffing leave and absence.